THORChain Versus the Internet Computer Protocol's Bitcoin Integration

Since the launch of ICP's Bitcoin integration earlier this month, several people have asked how the Internet Computer's technology differs from THORChain.

Since the launch of ICP's Bitcoin integration earlier this month, several people have asked how the Internet Computer's technology differs from THORChain.

THORChain Basics

For readers who may not yet have heard about THORChain, this new Web3 blockchain contender functions as a decentralized exchange for Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Binance Chain, and Tether. In principle, THORChain can also support any ERC-20 token created on Ethereum.

Like the Internet Computer, THORChain was designed to offer a fully on-chain alternative to centralized proprietary technology. Unlike the Internet Computer, however, THORChain has a much narrower focus — decentralized finance (DeFi) only. THORChain mainly seeks to address people's growing distrust of centralized exchanges like Coinbase, Kraken, Binance, and Bitfinex.

THORChain Liquidity Pool Integration

In contrast to the ICP blockchain's direct integration with Bitcoin via Chain Key Cryptography and a smart contract canister, THORChain facilitates multi-chain transactions indirectly using liquidity pools and incentivized user trust that relies on RUNE tokens.

Here's how it works.

- Some users, called liquidity providers, deposit their coins into liquidity pools in exchange for a percentage of RUNE token trading fees associated with the pool.

- Other users, called traders, approach the pool with one kind of coin and request another. For example, traders may swap ETH for BTC. To facilitate these swaps, the pool charges nominal fees in RUNE tokens.

- Node operators, who own and operate the computers that form the THORChain network, receive payment in RUNE tokens for hosting the liquidity pool.

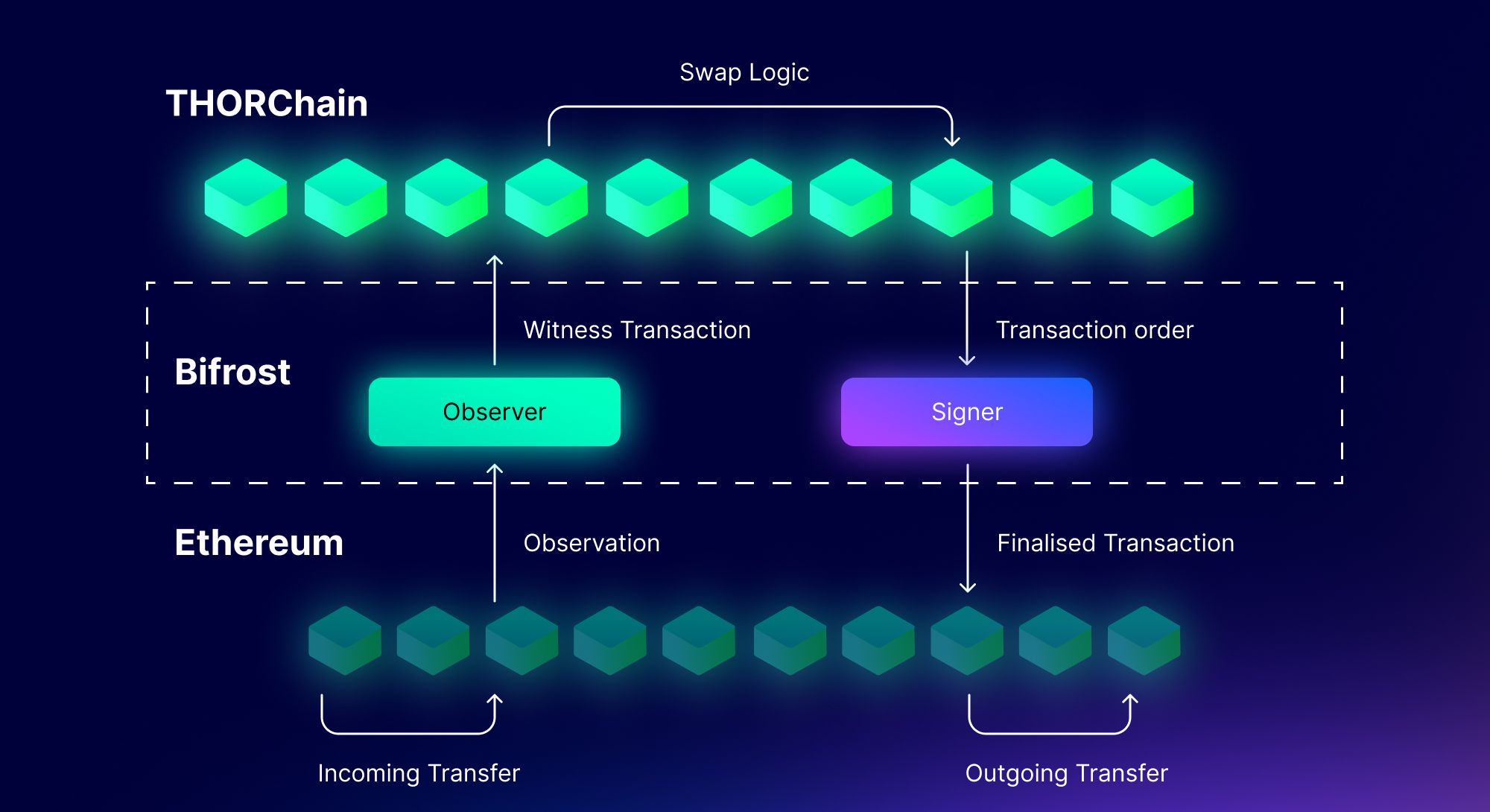

Rather than direct technical integration across blockchains, each THORChain node contains a parallel BTC node, ETH node, and so on and so forth, on which transactions are mirrored for each supported blockchain asset. To facilitate communications between these other blockchain nodes within each THORChain node, THORChain has what amounts to a built-in oracle or mediating service, thematically named the Bifröst.

THORChain RUNE Tokenomics

Everything, of course, hinges on the proper functionality and value of RUNE, a token with a fixed circulation of 500,000,000. RUNE is used to punish dishonest nodes through a bonded asset system. To ensure sufficient collateral, RUNE is designed to incentivize each liquidity pool to hold an amount of RUNE as bond worth twice the value of all other crypto assets in the pool.

Although THORChain is a blockchain, its solution to multi-chain integration can be viewed as economic rather than technological. It all boils down to RUNE tokenomics. As Erik Voorhees explains it:

"If RUNE has been designed correctly, THORChain may succeed. If RUNE has been designed poorly, THORChain will fail."

Potential Drawbacks of THORChain

To achieve success, THORChain will need to tackle challenges such as impermanent loss. In a nutshell, liquidity providers gain a percentage share of a liquidity pool at the time of an initial deposit. The downside of this arrangement, however, is that someone may be better off simply holding their coins rather than contributing to a liquidity pool.

For example:

- Alice deposits 1 ETH and 100 DAI in a liquidity pool when 1 ETH is worth 100 DAI.

- Suppose there’s a total of 10 ETH and 1,000 DAI in the pool; Alice has a 10% share.

- If the price of ETH rises to 400 DAI, the pool shifts to contain 5 ETH and 2,000 DAI.

- Now, if Alice withdraws her share, she will receive 0.5 ETH and 200 DAI, worth $400 USD.

If Alice had not contributed to the liquidity pool, she would have had 1 ETH and 100 DAI, worth $500 USD.

Now, had the value of coins actually decreased, as frequently happens during bear markets, an impermanent loss would compound losses rather than simply mitigating profits. There are, of course, impermanent loss protection techniques that liquidity pool exchanges use, but some risk always remains.

In the final analysis, contributors to liquidity pools on THORChain are acting on the assumption that trade fees in RUNE will offset any impermanent losses and that the value of RUNE will remain sufficiently stable to underwrite the costs of other assets.

Similarities to FTX

If THORChain's RUNE tokenomics and trade fee structure sound somewhat familiar, that's because RUNE has certain functional affinities to FTX's native crypto coin, FTT. While it is true that FTT holders received discounts on coin swaps and related services, whereas RUNE holders use RUNE as the medium to facilitate trade, the end result is analogous — assets on the exchange are safeguarded or backed by an exchange token.

Another similarity between THORChain and FTX is the importance of arbitrage trading for sustaining a profitable exchange. Arbitrage traders set market prices on THORChain, which defines the value of coin exchanges. These traders buy an asset on one market and sell it for a higher price on another market. While THORChain states that this mechanism allows market prices to be regulated naturally, it's worth noting that Sam Bankman-Fried built his empire on arbitrage trading with Bitcoin.

Arbitrage trading, as demonstrated by the downfall of FTX, may not be the best way to ensure regularization across markets. The profit derived from arbitrage trading is not based on any increase in the intrinsic value of the asset traded but is instead dependent on the value of a secondary currency. It is not yet known whether THORChain could withstand a liquidity crisis or cascade event across most of its nodes and liquidity pools. Moreover, it remains to be seen whether RUNE might face the same underwriting concerns currently facing Tether, which also filled a trade role on FTX somewhat comparable to RUNE's role on THORChain.

Infinity Swap and ICP's Bitcoin Integration

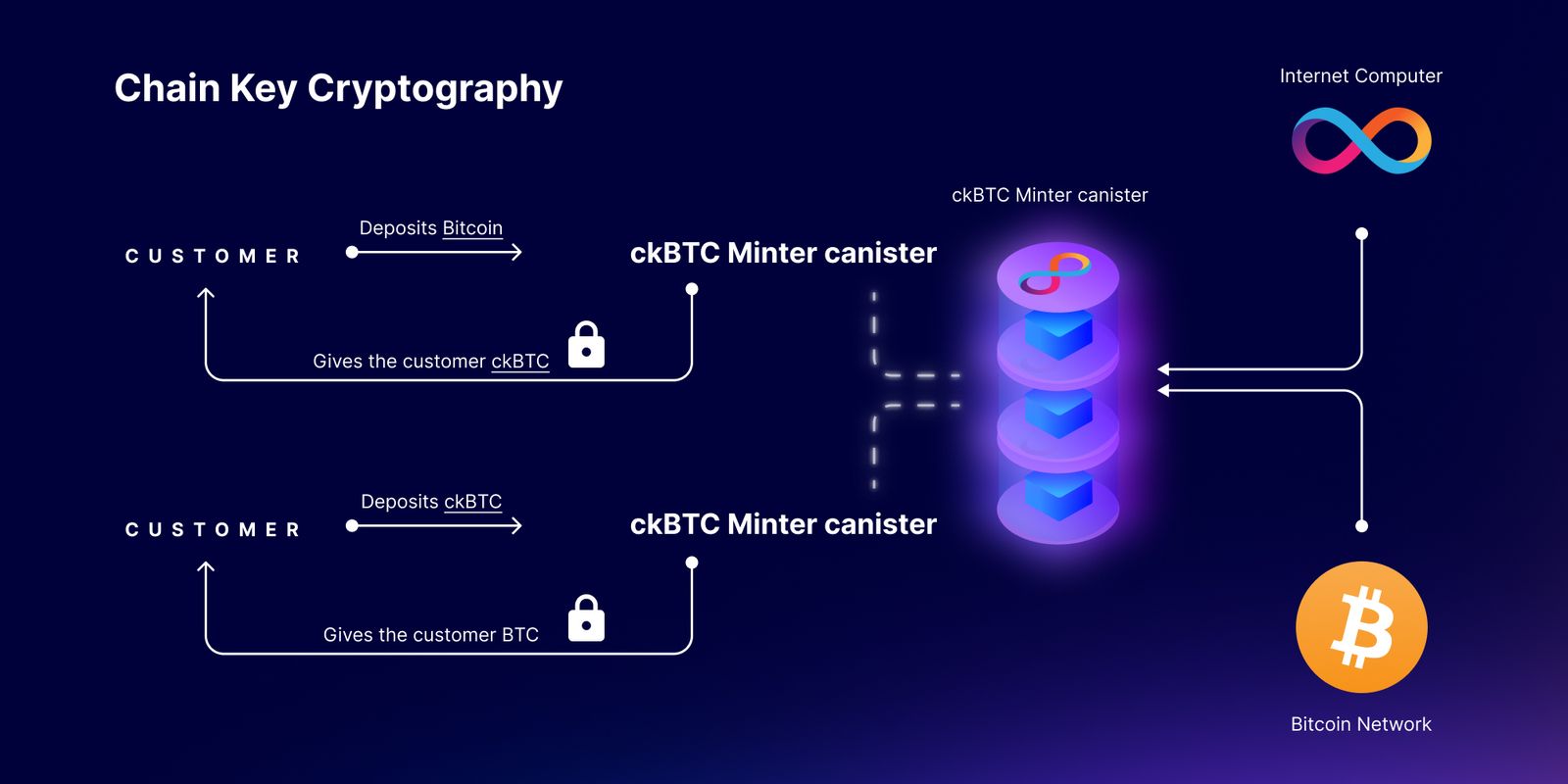

In contrast to THORChain's economic solution to multi-chain transactions, ICP's Bitcoin integration uses Chain Key cryptography to assign each smart contract canister its own Bitcoin public key, thus directly linking the Internet Computer with the Bitcoin network. In other words, smart contract canisters on the Internet Computer hold, send and receive their own Chain Key linked Bitcoin, ckBTC.

With ckBTC, a canister smart contract on the ICP blockchain is responsible for minting and redeeming tokens, not some centralized third party, mediating blockchain like Chainlink, or built-in oracle substitute such as THORChain's Bifröst. Additionally, Internet Computer users do not need to worry about liquidity providers and pools. There is no risk of impermanent loss or a liquidity crisis on the ICP blockchain.

Conclusion

THORChain is a truly innovative idea with a catchy Nordic naming scheme. However, assuming THORChain's decentralization and RUNE tokenomics can overcome challenges related to impermanent loss and liquidity crises, THORChain will still not be able to access any Web2 resource via HTTPS Outcalls, host sites fully on-chain, or function as a global Internet Computer blockchain that can do everything traditional Web2 services can at Web speed with cheap storage costs.

In conclusion, THORChain cannot compete with decentralized exchanges on the ICP blockchain. Infinity Swap, on the other hand, will leverage the Internet Computer's direct, native integration with other crypto blockchains without any need for a complicated system of liquidity pools and arbitrage trading to facilitate multi-chain transactions.

Connect with InfinitySwap

Twitter | Website | Telegram | Discord | Github

Comments ()